No Tax On Suggestions Information: Whatever You Require To Know About The Brand-new 2025 Legislation

Auto mishaps that trigger $1,000 or even more in residential property damage should be reported under Title 7, Chapter 550. Reports are also required if a crash causes an injury or death. Right here are the answers to some common questions vehicle drivers may have regarding Texas cars and truck crash regulations. Below, professionals discuss exactly how to pick the appropriate protection, the essential defense types and means to maintain your premiums inexpensive. Recognizing your options after a crash when you're without insurance but not at fault, including obligation guidelines, compensation challenges, and lawful considerations. Ultimately, promoting insurance policy recognition in your area can indirectly secure you.

Just How Do Insurance Coverage Restrictions Function?

Whether you're commuting to function, chauffeuring your youngsters around or running tasks, there's a good chance you're sharing the road with motorists who do not have cars and truck insurance coverage. When crashes occur in an at-fault state, the insurers of both parties review the details and make a judgment relating to which vehicle driver should be held responsible. Depending upon the information of the accident, the process of identifying that is or is not liable in a crash can be straightforward or really complicated. You can potentially be held accountable for discomfort and suffering or long term loss of income too, so it is vital that you have enough responsibility insurance policy to cover these expenditures. In several places, driving without insurance policy can result in shedding your motorist's permit.

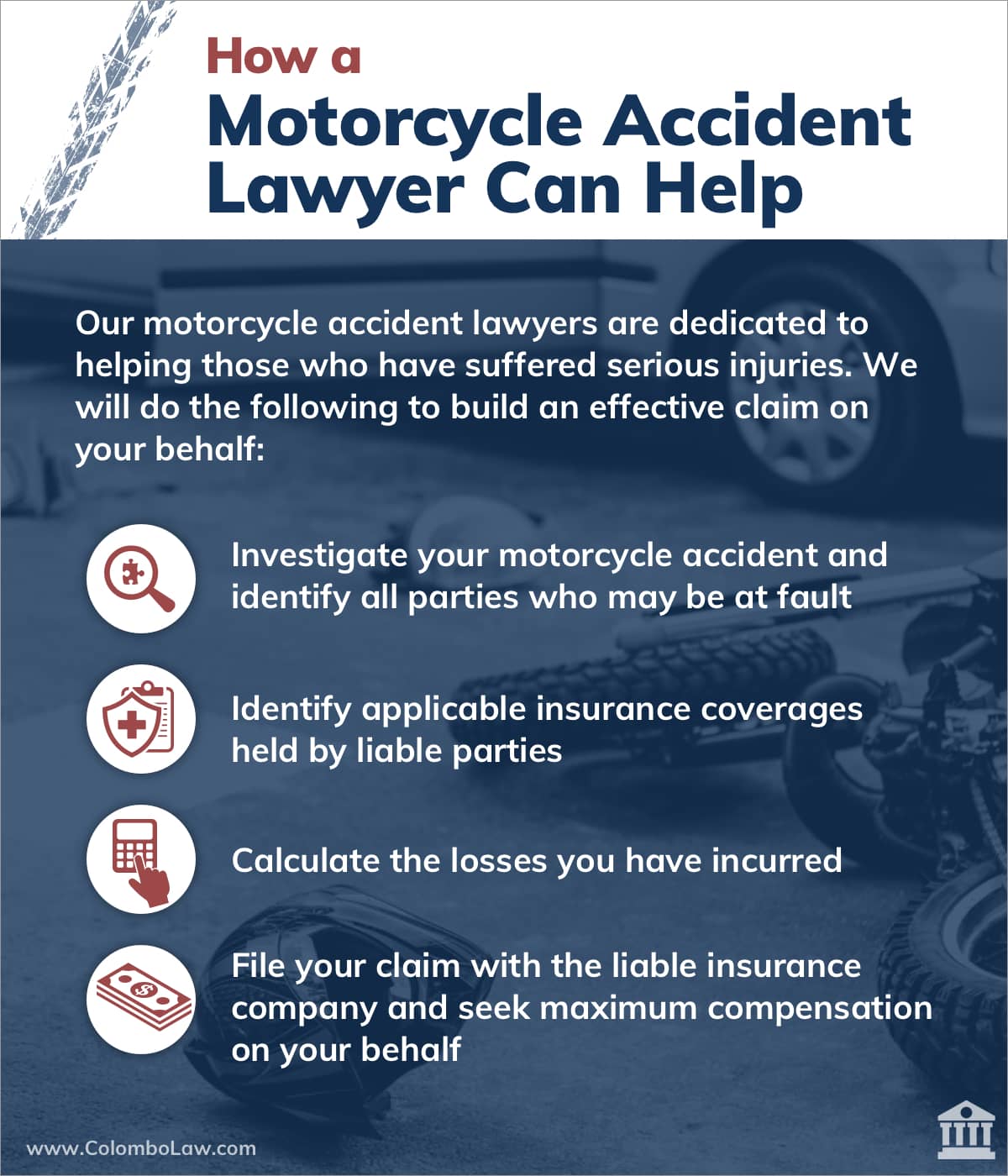

Talk With A Legal Representative You Can Trust Now

- You can sue them for personal assets if the motorist has them and recoup much more this way.If you're uncertain concerning your legal rights or need assistance negotiating, contact us today.For various other non-essential residential or commercial property, like a villa, the judgment must be submitted in every county where the accused has real estate.Regular culprits might also face community service or short-term prison time.However, if the at-fault motorist does not have insurance policy, you can not sue via their insurer, leaving you with fewer alternatives for settlement.

If the at-fault chauffeur doesn't have insurance, mishap targets face many problems. You may have clinical expenses, property damage, lost wages, and major injuries with no very easy means to earn money. Given that there is no obligation insurance, you can not sue versus their automobile insurer. You may require to make use of without insurance motorist protection from your very own auto insurance plan. The state calls for $30,000 for physical injury each, $60,000 for Check out this site overall physical injury per crash, and $25,000 for home damages. This liability insurance coverage spends for medical costs, residential or commercial property damages, and other losses caused by the at-fault chauffeur.

A lawyer simplifies this process, handling the documents, communication, and arrangement in your place. In certain territories, police has the authority to take your lorry if you're captured driving without insurance coverage. If you are in charge of a crash, your price will certainly usually rise unless your insurer uses some kind of crash mercy feature. For instance, with Progressive's Large Accident Forgiveness, your rate will not raise in many states if you're at fault in a mishap with a case surpassing $500.